Mortgage rates. Everyone's obsessed, right? The news breathlessly reports every fractional uptick or dip. But let’s be real: what's actually happening? We're supposedly navigating this economic minefield, but the data suggests something far less dramatic.

The headlines scream about "fluctuating" rates. Zillow and Optimal Blue are throwing numbers at us daily. But if you squint hard enough at the data, you'll see that the 30-year fixed mortgage rate has been stuck in a remarkably tight range for weeks (six weeks, give or take a day, according to one report). We're talking about hundredths of a percentage point here. For example, Zillow says the average is 6.11%. Optimal Blue clocks in at 6.236%. That discrepancy (a mere 0.126%) is hardly cause for panic or celebration.

And let's not forget the historical context. We're all spoiled by those artificially suppressed rates of the pandemic era. People are walking around with "golden handcuffs," as one article puts it, chained to those sweet, sweet 2-3% mortgages. But a quick glance at a chart of historical rates shows that 6-7% is hardly unusual. In the '90s, it was basically the norm. The Fed chart tracking Freddie Mac data is pretty clear on that point.

So, what's driving this obsession with minor fluctuations? Hype, mostly. A desperate need for news outlets to fill column inches. The real story isn't the daily wiggles, but the overall stagnation. Mortgage and refinance interest rates today, November 22, 2025: Stuck in a range for 6 weeks

Of course, the devil's in the details. Those national averages mask significant variations. Your credit score, down payment, and debt-to-income ratio (DTI) all play a huge role. As one article points out, a score of 740 or higher is considered "top tier". And that DTI? Aim for 36% or below.

And this is the part of the report that I find genuinely puzzling. While the media focuses on these tiny rate movements, they often gloss over the importance of shopping around. Freddie Mac research suggests that borrowers could save $600 to $1,200 annually by comparing offers from multiple lenders. That's real money, people.

But let's be honest, who actually does that? Most people take the first offer that comes their way, blinded by the shiny promise of homeownership. They don't bother to crunch the numbers, to compare APRs (which, as one article rightly points out, is the real cost of borrowing). They're too busy dreaming of granite countertops and walk-in closets.

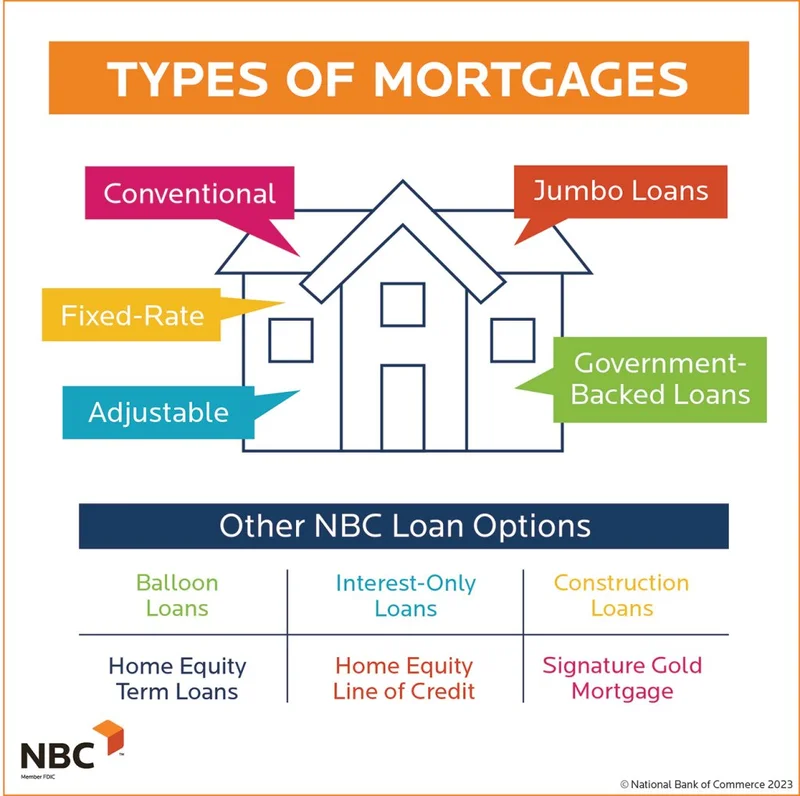

And what about adjustable-rate mortgages (ARMs)? While they might seem tempting with their initially lower rates, they're a gamble. Unless you're planning to flip the property before the rate adjusts, you're basically playing roulette with your finances. Some articles suggest fixed rates are actually lower, which is a bizarre anomaly.

Everyone's watching the Federal Reserve, waiting for them to slash interest rates. But even if they do, don't expect a sudden plunge in mortgage rates. The Fed doesn't directly control mortgage rates. Their actions influence them, sure, but the market is a complex beast.

The Fed's balance sheet is another crucial factor. As they unwind their holdings of mortgage-backed securities (MBS), that puts upward pressure on rates. So, even if they cut the federal funds rate, the impact on mortgage rates might be muted.

The current economic climate—tariffs, deportations, inflation fears—adds another layer of uncertainty. As one article notes, some observers fear that President Trump's policies could tighten the labor market and reignite inflation. If that happens, mortgage rates could spike.

And what about the impact of the government shutdown? Economists are watching closely, but the long-term effects are hard to predict.

The mortgage rate market is stuck in a rut. The daily fluctuations are mostly noise. Focus on your personal finances (credit score, DTI, down payment) and shop around for the best deal. Don't get distracted by the headlines. And for God's sake, do the math before you sign on the dotted line.