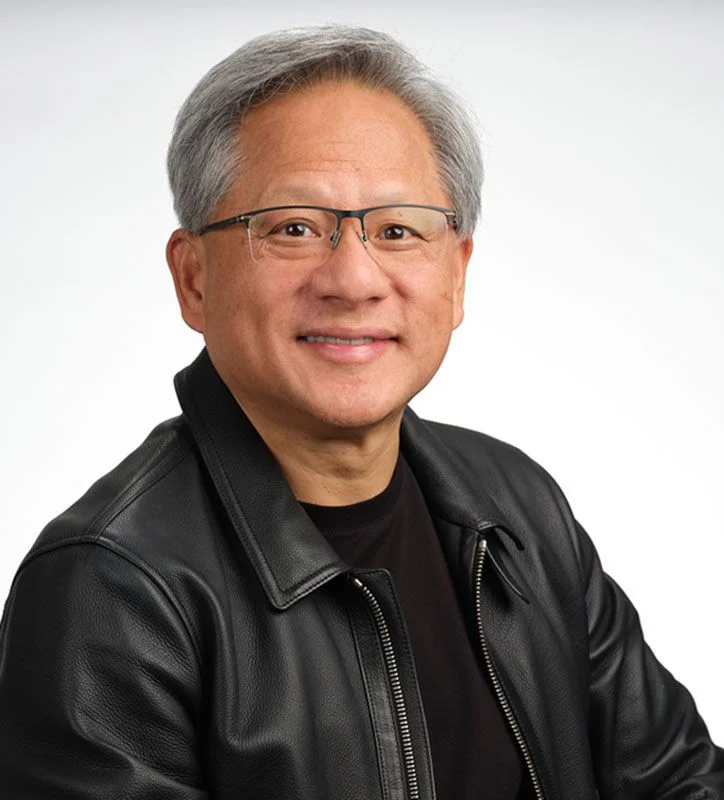

Alright, so Jensen Huang says Nvidia's got $500 billion in demand lined up for their Blackwell and Rubin chips. Five hundred billion. Let's just let that number sink in for a second. You could buy, like, a small country with that kind of cash.

This whole thing stinks of the dot-com bubble 2.0. Remember Pets.com? Webvan? Yeah, me too. Companies promising the moon and delivering... well, nothing much. This feels eerily similar. Huang throws out this massive number at GTC 2025, the stock jumps 10%, and everyone's suddenly convinced Nvidia can do no wrong.

Look, I get it. AI is hot. Everyone wants a piece of the action. But $500 billion in demand isn't the same as $500 billion in revenue. It's like saying I demand a private jet. Doesn't mean I'm about to write a check for one.

And what's this about them investing $1 billion in Nokia for 5G and 6G? Seriously? Nokia? Last time I checked, they were still trying to figure out how to make a decent smartphone. Call me crazy, but that seems like throwing good money after bad. I mean, I love my grandma's old Nokia brick phone, but...

Okay, let's look at the actual numbers. Nvidia's trailing-12-month revenue is $165 billion. Not bad, right? But they're projecting $278 billion next year. That's a massive jump. And they need to keep that pace to even sniff $500 billion over five quarters.

Here's the question nobody seems to be asking: Where is all this money actually coming from? Data center spending might hit $4 trillion by the end of the decade, sure. But Nvidia isn't the only player in town. AMD, Intel, a whole bunch of custom AI chip designers are all vying for a piece of that pie. And Huang's comment about competition reassuring investors? Please. That's PR spin 101. Some analysts, however, see this as a reason to invest, as detailed in Jensen Huang Just Gave Investors 1 Incredible Reason to Buy Nvidia Stock Hand Over Fist - The Motley Fool.

And don't even get me started on this Oracle partnership. They're building an AI supercomputer for the Department of Energy. Great. More government contracts, more bureaucracy, more cost overruns. It's gonna be a total sh*tshow, I'm calling it now.

Oh, and the stock price is around $200. Up 10% since the announcement. People are offcourse buying into the hype. Makes you wonder how many of these "investors" actually understand what Nvidia does, or if they're just chasing the green candle.

I'm not saying Nvidia is going to collapse tomorrow. They're still a powerhouse. But this kind of unchecked hype, these wild projections, they never end well. It's like watching a slow-motion train wreck. You know it's coming, but you can't look away.

Maybe I'm just a grumpy old cynic. Maybe Nvidia really is going to revolutionize the world with their AI chips. Maybe pigs will fly. But I'm not holding my breath.